Apple has started to roll out limited access to Apple Pay Later to select users before rolling it out to everybody. In this article, I’m going to walk you through how the process works, what kind of credit check Apple has to do, and why you may want to hold off before making a bunch of purchases with Apple’s new Buy Now Pay Later service.

How Apple Pay Later Works

Here are the basics of how it works: Apple Pay Later is just the latest Buy Now Pay Later service. There are many of these services available, and Apple is the newest player in the game. It allows you to buy something now, whether it’s a product or a service, and pay for it later. Apple allows you to buy things ranging from $50 to a thousand dollars, depending on your credit checks, and it splits the payments into four equal installments, every two weeks. So, if your purchase is $100, you would pay it off in four $25 payments, interest-free.

In many situations, it can be a lifesaver. Let’s explore how to use it.

Using Apple Pay Later

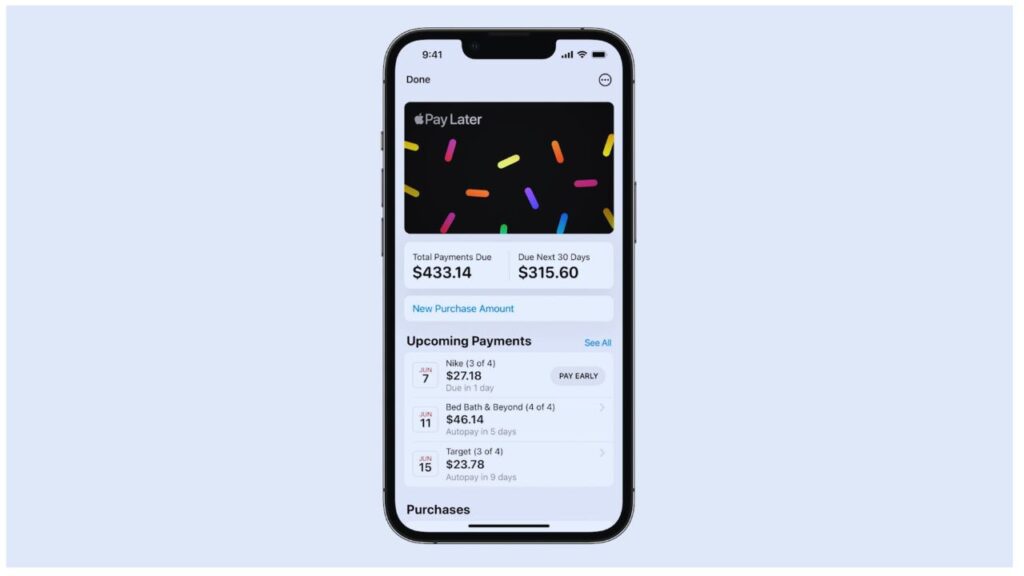

If you get access to Apple Pay Later, you’ll see an alert appear at the top of the Wallet application. It will provide you with more information on Apple Pay Later, helping you understand how to start using it. When you want to use it, you have two options:

1. At the Point of Sale

You can use Apple Pay Later at the point of sale, whether you’re checking out online or in person. There’s a separate tab when you open Apple Pay that allows you to choose whether to pay now using your credit card or bank on file or use Apple Pay Later to split the payment into four equal, interest-free installments.

2. Pre-Authorization

Alternatively, you can get pre-authorized. You can enter the amount you’d like to be approved for before heading into a store to make a purchase. If you end up spending less than the pre-authorized amount, it will simply go away, and you can’t save it for a future purchase. You’ll need to go through the authorization process again.

To pre-authorize an amount, tap into it inside the Wallet application, and tap on “continue.” You can then request the desired spending amount. It will check your eligibility, and you can proceed to check out with Apple Pay.

The Authorization Process

The authorization process involves a soft credit check, which means it checks your credit but doesn’t negatively impact your credit score. So, you don’t need to worry about your credit score taking a hit just because you want to try out Apple Pay Later.

Making a Purchase

Once you’re approved, you can proceed to make a purchase. For instance, if you’re shopping online, you’ll see a new tab for Apple Pay Later at checkout. It will break down your purchase price into four payments. The first payment is due at the time of purchase, and the remaining three payments are spaced two weeks apart. This means you’ll pay only a fraction of the total cost upfront.

However, it’s crucial to exercise caution. While these Buy Now Pay Later services may seem convenient, they can lead to financial trouble if not used responsibly. If you don’t fully pay off your debt after those four payments, you will be charged interest on the remaining amount, adding to your financial burden.

In some situations, these services can be lifesavers, allowing you to cover essential expenses until your next paycheck. But if used frequently, they can lead to mounting debt. So, always make smart financial decisions for yourself.

Conclusion

So, what do you think? Are you planning to try out Apple Pay Later, or have you already gained access to it?